What Are Your Odds of Being Audited By the IRS?

Provided by Nathan Cacka, CPA, Cordell, Neher & Company, Wenatchee Certified Public Accountant

Provided by Nathan Cacka, CPA, Cordell, Neher & Company, Wenatchee Certified Public Accountant

Though the fear of an audit is great, the risk is actually extremely low. Fewer than 1% of Americans have their Federal taxes audited. In fact, the percentage has been declining recently due to Internal Revenue Service budget cuts. In 2016, just 0.7% of individual returns were audited (1 of every 143). That compares to 1.1% of individual returns in 2010.1,2

Now that we know that the chances of being audited are low, the question becomes, what are some “red flags” that will increase the chances of your return being part of the “chosen few”.

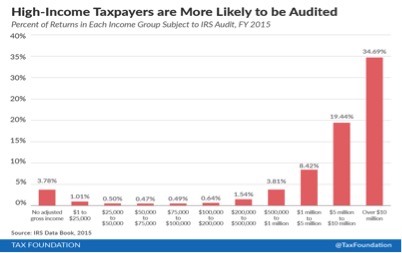

The wealthy and lower-income taxpayers are more likely to be audited. This is because an audit of a wealthy taxpayer could result in a “big win” for the IRS. With lower incomes, the IRS simply cannot dismiss returns that claim implausibly large credits and deductions. Data compiled by Tax Foundation, a non-profit, provides the graph below, which clearly illustrates the spread of the 2015 IRS Audits.2

Abnormally large deductions could give the IRS pause. The IRS uses computerized analytical tools to determine if deductions are outside the norm. For example, suppose that you earned $95,000 in 2016 while claiming a $15,000 charitable deduction. Forbes estimates that the average charitable deduction for such a taxpayer last year was $3,529.3

Even the type of deduction can cause suspicion. For instance:

- Taking the Earned Income Tax Credit (EITC) without any adjusted gross income

- Claiming a business expense for a service or good that seems irrelevant to your line of work

- A home office deduction, if the “office” amounts to a room in your house that serves other purposes 4

- Claiming 100% business use of an automobile, when there is no other vehicle available for personal use

- Excessive mileage deductions in comparison to similar tax filer data

Claiming an alimony deduction increases focus by the IRS. The rules on deducting alimony are complicated, and the IRS knows that some filers who claim this write-off do not satisfy the requirements. Mismatching between the payer and the recipient on their respective returns will almost certainly trigger an audit or at least an IRS notice. This will become even more complicated with the Tax Reform passed at the end of 2017 with regard to alimony.

Self-employment can increase your audit potential. For example, in 2015 taxpayers who filed a Schedule C listing business income of $25,000-$100,000 had a 2.4% chance of being audited.2

Continuous years of business losses may result in further inquiry by the IRS. Several years of Schedule C or F business losses from an activity that appears to the IRS to be a hobby can wave a red flag. To determine if you have a hobby or a business, ask yourself: is there a profit motive or expectation central to the activity (business), or is it simply a pastime offering an occasional chance for financial gain (hobby)?

Failure to take a Required Minimum Distributions (RMDs) will draw scrutiny as well. The IRS does watch RMDs closely. Retirees who neglect to withdraw required amounts from IRAs and employer-sponsored retirement plans can be subject to a penalty equal to 50% of the amount not withdrawn on time.1

Foreign activity may raise attention. Failure to report financial interest or signature authority over foreign financial accounts with a combined total of more than $10,000 at any time during the year will cause your return to be investigated. The IRS is intensely interested in people with money stashed outside the US, especially in countries with the reputation of being tax havens.

Finally, the fastest way to invite an audit might be to file a paper return. The error rate on hard copy returns is substantially higher than electronically filed returns. So, if you still drop your 1040 Form off at the post office each year, you may want to try e-filing in the future.4

Nathan Cacka is a Certified Public Accountant with Cordell, Neher & Company, PLLC, a Wenatchee public accounting firm. Nathan may be reached at 509-663-1661 or nathan@cnccpa.com.

Citations.

- kiplinger.com/slideshow/retirement/T056-S011-9-irs-audit-red-flags-for-retirees/index.html [3/17]

- fool.com/retirement/2017/02/06/here-are-the-odds-of-an-irs-audit.aspx [2/6/17]

- forbes.com/sites/baldwin/2017/01/23/tax-guide-deductions-and-audit-risk/ [1/23/17]

- fool.com/retirement/2016/12/19/9-tax-audit-red-flags-for-the-irs.aspx [12/19/16]

Events & Deadlines

Latest Past Events

Community Service Day

Cordell Neher & Company, PLLC 175 E Penny Rd #1, Wenatchee2024 Shred Event

Cordell Neher & Company, PLLC 175 E Penny Rd #1, WenatcheeCNC Newsletter

Subscribe and stay informed on policy changes that could have an impact on you.

Footer Contact

Check the background of your financial professional on FINRA's BrokerCheck®

Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor. Cordell, Neher & Company, PLLC makes every attempt to ensure that the information contained on their websites are obtained from reliable sources, but is not responsible for any errors and/or omissions or from the results obtained from the use of any information. This site contains links to servers maintained by other organizations. Cordell, Neher & Company, PLLC cannot provide any warranty regarding the accuracy or source of information found on any of these servers, the content of any file the user might use to download from a third-party site, and is not responsibility for the content found on any of these servers or for any links these servers maintain with other servers.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM,Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100 Dallas, TX 75019 972-870-6000.

Avantax financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services.SM, Member FINRA, SIPC. Investment Advisory Services offered through Avantax Advisory Services SM. Insurance services offered through an Avantax affiliated insurance agency. Method 10® is property of Avantax Wealth Management.SM All rights reserved 2020. The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth ManagementSM does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth ManagementSM or its subsidiaries. Avantax Wealth ManagementSM is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products: Are not insured by the FDIC or any federal government agency- Are not deposits of or guaranteed by the bank or any bank affiliate- May lose Value

Avantax Investment ServicesSM and Avantax Advisory ServicesSM are not affiliated with CNC Financial Group, LLC.

© 2024 Cordell, Neher & Company PLLC • Designed by Pixel to Press