Four Areas to Consider if You Want to Revisit Your Advisor Relationship in 2024

Authored by: Bradi Dahmen, Director of Wealth Management at Cordell, Neher & Company, PLLC

At every life stage, you’re presented with unique challenges and opportunities. As we begin a new year, working with a financial advisor who understands the importance of financial planning through a tax-smart lens has never been more essential for navigating these challenges effectively. However, not all wealth management firms are created equal.

So, what is tax-smart planning and investing? This approach involves analyzing all aspects of your financial life – from retirement savings to investments, risk management, legacy planning and more – with a focus on minimizing your tax liabilities to maximize your financial opportunities.

Tax-Intelligent Planning

Nearly every financial decision has tax implications. In 2024, a holistic approach means that your financial advisor is collaborating with your accountant to identify opportunities that maximize your tax benefits. Tax-intelligent planning ensures you’re leveraging tax-efficient investment products, strategically timing contributions and withdrawals, utilizing tax-loss harvesting and more to avoid paying unnecessary taxes. In fact, the potential value of working with an advisor can add approximately 5% annually to your portfolio, while 1.7% of that total percentage can be attributed to tax-intelligent advice.1

Proactive Management

Letting “auto pilot” guide your investment portfolios won’t always yield positive results and may cause more harm than good. Your financial advisor should proactively approach your financial investments by actively rebalancing portfolios to help you maximize returns and pursue optimal long-term growth.

Behavioral Guidance

Over the years, I’ve found that many clients repeat the same behaviors when it comes to financial matters without thinking or having a particular reason to do so. Together, it’s important to identify the behaviors holding you back and develop strategies to overcome them. By doing this, you can make rational decisions that will keep you on track toward your financial goals.

Personalized Experience

Your financial advisor should prioritize custom financial planning for your family and business to adapt with your changing needs, instead of following a ‘one size fits all approach.’ Comprehensive financial plans consider your unique circumstances, possible scenarios and data you need to make informed decisions – all while discussing your goals, future plans and more to build a plan that works for your needs.

No matter what season of life you’re in, working with a financial advisor that has an understanding of taxation can be one of your greatest assets at every stage. For more information, visit our website at cnccpa.com or give us a call at (509) 663-1661, and we’ll begin helping you, your family or your business today.

Events & Deadlines

Latest Past Events

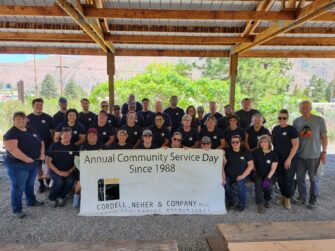

Community Service Day

Cordell Neher & Company, PLLC 175 E Penny Rd #1, Wenatchee2024 Shred Event

Cordell Neher & Company, PLLC 175 E Penny Rd #1, WenatcheeCNC Newsletter

Subscribe and stay informed on policy changes that could have an impact on you.

Footer Contact

Check the background of your financial professional on FINRA's BrokerCheck®

Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor. Cordell, Neher & Company, PLLC makes every attempt to ensure that the information contained on their websites are obtained from reliable sources, but is not responsible for any errors and/or omissions or from the results obtained from the use of any information. This site contains links to servers maintained by other organizations. Cordell, Neher & Company, PLLC cannot provide any warranty regarding the accuracy or source of information found on any of these servers, the content of any file the user might use to download from a third-party site, and is not responsibility for the content found on any of these servers or for any links these servers maintain with other servers.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM,Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100 Dallas, TX 75019 972-870-6000.

Avantax financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services.SM, Member FINRA, SIPC. Investment Advisory Services offered through Avantax Advisory Services SM. Insurance services offered through an Avantax affiliated insurance agency. Method 10® is property of Avantax Wealth Management.SM All rights reserved 2020. The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth ManagementSM does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth ManagementSM or its subsidiaries. Avantax Wealth ManagementSM is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products: Are not insured by the FDIC or any federal government agency- Are not deposits of or guaranteed by the bank or any bank affiliate- May lose Value

Avantax Investment ServicesSM and Avantax Advisory ServicesSM are not affiliated with CNC Financial Group, LLC.

© 2024 Cordell, Neher & Company PLLC • Designed by Pixel to Press