Affordable Care Act Worksheet & Resource Article

Affordable Care Act Worksheet

We know that the Affordable Care Act (“ACA”) is confusing and it may be difficult to understand how it affects you and/or your business. To offer our clients additional assistance we have created the Affordable Care Act Worksheet to assist you in calculating full time and Full Time Equivalent (FTE) employees.

We invite you to contact Kristine Loomis, CPA, CVA of our office to assist you in assessing your business needs. We believe having a trusted CPA help you through this challenging process makes good business sense, and it is just one of the many additional services we can provide to you.

Also, see below a recent article by the IRS regarding these calculations. As more requirements, notices or information becomes available we will continue to share that information in our ongoing efforts to assist you on your path to success.

Averaging Full-time and Full-time Equivalent Employees, and Why it Matters

February 3, 2016

For purposes of the Affordable Care Act, employers average their number of employees across the months in the year to see whether they will be an applicable large employer. This is important to do because two provisions of the health care law apply only to ALEs and are now in effect. These are the employer shared responsibility provision and the employer information reporting provision for offers of minimum essential coverage. In addition, self-insured ALEs – that is, employers who sponsor self-insured group health plans – have additional provider information reporting requirements.

Remember that the vast majority of employers will fall below the ALE threshold number of employees and, therefore, will not be subject to the employer shared responsibility provisions.

Here are definitions to three terms that are significant in determining whether your organization is an ALE. In general:

- A full-time employee is an employee who is employed on average, per month, at least 30 hours of service per week, or at least 130 hours of service in a calendar month.

- A full-time equivalent employeeis a combination of employees, each of whom individually is not a full-time employee, but who, in combination, are equivalent to a full-time employee.

- An aggregated group is commonly owned or otherwise related or affiliated employers, which must combine their employees to determine their workforce size.

To determine if your organization is an applicable large employer for a year, count your organization’s full-time employees and full-time equivalent employees for each month of the prior year. If you are a member of an aggregated group, count the full-time employees and full-time equivalent employees of all members of the group for each month of the prior year. Then average the numbers for the year. Employers with 50 or more full-time equivalent employees are applicable large employers and will need to file an annual information return reporting whether and what health insurance they offered employees. In addition, they are subject to the .

There are many additional rules on determining who is a full-time employee, including what counts as hours of service. For more information on these rules, see the employer shared responsibility final regulations and related questions and answers on IRS.gov.

For more information, see the Determining if an Employer is an Applicable Large Employer page on IRS.gov/aca.

Events & Deadlines

Latest Past Events

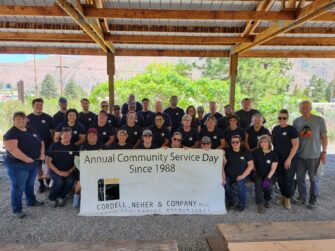

Community Service Day

Cordell Neher & Company, PLLC 175 E Penny Rd #1, Wenatchee2024 Shred Event

Cordell Neher & Company, PLLC 175 E Penny Rd #1, WenatcheeCNC Newsletter

Subscribe and stay informed on policy changes that could have an impact on you.

Footer Contact

Check the background of your financial professional on FINRA's BrokerCheck®

Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor. Cordell, Neher & Company, PLLC makes every attempt to ensure that the information contained on their websites are obtained from reliable sources, but is not responsible for any errors and/or omissions or from the results obtained from the use of any information. This site contains links to servers maintained by other organizations. Cordell, Neher & Company, PLLC cannot provide any warranty regarding the accuracy or source of information found on any of these servers, the content of any file the user might use to download from a third-party site, and is not responsibility for the content found on any of these servers or for any links these servers maintain with other servers.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM,Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100 Dallas, TX 75019 972-870-6000.

Avantax financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services.SM, Member FINRA, SIPC. Investment Advisory Services offered through Avantax Advisory Services SM. Insurance services offered through an Avantax affiliated insurance agency. Method 10® is property of Avantax Wealth Management.SM All rights reserved 2020. The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth ManagementSM does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth ManagementSM or its subsidiaries. Avantax Wealth ManagementSM is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products: Are not insured by the FDIC or any federal government agency- Are not deposits of or guaranteed by the bank or any bank affiliate- May lose Value

Avantax Investment ServicesSM and Avantax Advisory ServicesSM are not affiliated with CNC Financial Group, LLC.

© 2024 Cordell, Neher & Company PLLC • Designed by Pixel to Press