Wrapping Up 2024: Here’s What You Need to Review Financially

Authored by: Jason Underwood, CFP®

As the year winds down, it’s time to take stock of your financial situation and make sure you’re in the best position to transition into 2025. Year-end financial planning is an excellent opportunity to assess your progress and take steps that can have lasting benefits for your wealth, tax planning, and retirement strategy. Here are some key areas to consider as 2024 comes to a close.

Maximize Retirement Contributions: Take a moment to review your retirement accounts, including 401(k)s, IRAs, and other investment plans. If you haven’t maxed out your contributions, consider doing so before December 31. For those over 50, take advantage of catch-up contributions, which allow you to save even more on a tax-deferred basis.

By reviewing your retirement accounts now, you can increase your chances on meeting long-term goals and perhaps even reduce your taxable income for the year.

Review Your Tax Situation: Year-end tax planning can make a meaningful difference to your overall tax liability. Now is the time to work with your tax advisor to review any realized capital gains or losses, to verify cost-basis information is in order and confirm if there are opportunities for tax-loss harvesting. It’s also crucial to revisit last year’s carried-forward losses, as they can be applied to offset gains this year.

Selling assets? Be sure to understand how capital gains taxes could impact your return. Planning ahead will give you a clearer picture and help you avoid surprises when you file in 2025.

Plan for Charitable Giving: Charitable contributions are an impactful way to support causes you care about while reducing your taxable income. Before the year ends, consider making donations to qualified charities or setting up education savings plans for loved ones.

In 2024, the annual federal gift tax exclusion allows you to give up to $18,000 per person without triggering gift tax consequences. This is a great opportunity to make meaningful gifts to family members or fund trusts. Just remember that trust planning comes with its own tax considerations, so be sure to work with a knowledgeable advisor.

Review Life Insurance Policies: Now is an ideal time to check your life insurance policies and beneficiaries. Have your financial needs changed? Have you had any major life events that would impact your coverage? Make sure you’re still adequately insured and that your policies reflect your current circumstances.

Remember that factors like age, health, and policy type affect cost and availability. If you’re thinking of updating or purchasing new coverage, assess whether you’re still insurable and work with your insurance provider to confirm the policy’s guarantees are solid.

Reflect on Major Life Events: Any significant life changes this year? These could include:

- Marriage or divorce

- Moving or relocating

- Changing jobs or retiring

- Buying a home or starting a business

- Receiving an inheritance or making large gifts

- Welcoming a new addition to the family

Each of these events can have financial consequences that might affect your retirement planning, insurance needs, or overall investment strategy. Be sure to discuss these changes with your financial advisor during your annual review to help align with your financial plan with your current life situation.

Year-end planning is about more than just tying up loose ends; it’s an opportunity to take meaningful steps that can improve your financial future. By reviewing key aspects of your financial life now, you’ll be better prepared for the new year. Remember to lean on your financial advisor for guidance and help to align your strategy on pursing your broader goals. To learn more, visit our website at cnccpa.com or call us at (509) 663-1661.

Events & Deadlines

Latest Past Events

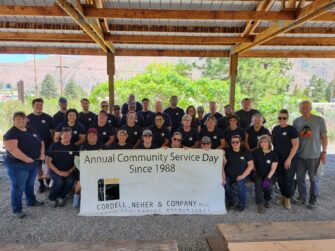

Community Service Day

Cordell Neher & Company, PLLC 175 E Penny Rd #1, Wenatchee2024 Shred Event

Cordell Neher & Company, PLLC 175 E Penny Rd #1, WenatcheeCNC Newsletter

Subscribe and stay informed on policy changes that could have an impact on you.

Footer Contact

Check the background of your financial professional on FINRA's BrokerCheck®

Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor. Cordell, Neher & Company, PLLC makes every attempt to ensure that the information contained on their websites are obtained from reliable sources, but is not responsible for any errors and/or omissions or from the results obtained from the use of any information. This site contains links to servers maintained by other organizations. Cordell, Neher & Company, PLLC cannot provide any warranty regarding the accuracy or source of information found on any of these servers, the content of any file the user might use to download from a third-party site, and is not responsibility for the content found on any of these servers or for any links these servers maintain with other servers.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM,Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100 Dallas, TX 75019 972-870-6000.

Avantax financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services.SM, Member FINRA, SIPC. Investment Advisory Services offered through Avantax Advisory Services SM. Insurance services offered through an Avantax affiliated insurance agency. Method 10® is property of Avantax Wealth Management.SM All rights reserved 2020. The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth ManagementSM does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth ManagementSM or its subsidiaries. Avantax Wealth ManagementSM is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products: Are not insured by the FDIC or any federal government agency- Are not deposits of or guaranteed by the bank or any bank affiliate- May lose Value

Avantax Investment ServicesSM and Avantax Advisory ServicesSM are not affiliated with CNC Financial Group, LLC.

© 2024 Cordell, Neher & Company PLLC • Designed by Pixel to Press