Tax Newsletter

How To Pivot Your Accounting Operations and Cope With COVID-19

By Nathan Cacka, CPA Cordell, Neher & Company, PLLC Companies are being forced to pivot and adapt both internally in how they handle operations and externally in how they interact…

Read MoreHow Your Credit May Affect Your Life Insurance Premiums

You may be surprised to learn about the potential relationship. Provided by Charlie Miracle, CPA at Cordell, Neher & Company, PLLC Does your credit history partly determine the cost of…

Read MoreFMLA: Paid Family And Medical Leave Update

Download update article: FMLA 4/1/19

Read MoreCyberSecurity: Threat Awareness is your Best Defense

By Martin Straub Martin Straub is the owner of SimplePowerIT, LLC, an affiliate of Cordell, Neher & Company, PLLC, and provides cybersecurity and technology solutions and support to NCW businesses…

Read MoreWhat You Need to Know About the 2018 Tax Law

By Timothy M. Dilley, CPA, Cordell, Neher & Company, P The tax reform legislation that Congress approved in December of 2017 was the largest change to the tax system in…

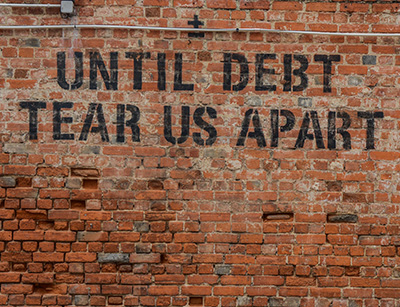

Read MoreTax Debt and the IRS

By Mariette “Pete” Luchini, CPA, Wenatchee Certified Public Accountant Arguably one of the worst ways to spend your time is dealing with the IRS over tax debt. It ranks with…

Read MoreWhat You Need to Know About the Incoming Tax Law

By Mariette “Pete” Luchini, CPA, Cordell, Neher & Company, Wenatchee, Certified Public Accountant The Tax Cuts and Jobs Act created by our government in late December is the largest change…

Read More10 Things to Know About Identity Theft and Your Taxes

By Timothy M. Dilley, CPA, Wenatchee Certified Public Accountant Learning you are a victim of identity theft can be a stressful event. Identity theft is also a challenge to businesses,…

Read MoreSaving for College

Invest time in planning for higher education By Mariette “Pete” Luchini, CPA, Cordell, Neher & Company, Wenatchee, Certified Public Accountant Today, a post-secondary education is a minimum requirement for most…

Read More