Identify Theft – by Kristine Loomis, CPA, CVA

By Kristine Loomis, CPA, CVA, Wenatchee Certified Public Accountant; in collaboration with Accountants: Amanda Stephens, Accountant and Nathan Harmon

By Kristine Loomis, CPA, CVA, Wenatchee Certified Public Accountant; in collaboration with Accountants: Amanda Stephens, Accountant and Nathan Harmon

Identity Theft - Protecting Yourself and Recovering from Tax Return Fraud

Daily we hear about a new data breach exposing personal credit and financial information. Even the IRS isn’t immune. They recently announced their “Get Transcript” application was hacked allowing access to over 100,000 tax returns. Hackers break into information databases to gather confidential information such as social security numbers, credit card numbers, bank account numbers and other secure information. The bigger problem is the use of the information: it can be used to set up accounts, make purchases, obtain false identification or file tax returns. All of these data breaches are concerning, but when you combine identity theft with the IRS most of us react with panic and anger.

What is the biggest impact in regard to the IRS? Refund fraud.

The biggest problem for taxpayers is a false tax return being filed under their name. It provides an opportunity for the thief to receive a refund before anyone is aware. For example, someone obtains personal information to create a return. Once they are able to fill out the return, all of the income and payments can be manipulated to create a large refund. The return can be filed and they receive the refund. It can take the IRS months to match wage and expense information to the filed tax return; by which time the criminal has the funds and is long gone before fraud is detected.

Most taxpayers find out they are a victim of IRS identity theft in one of two ways: a letter from the IRS reporting suspicious activity or an electronically filed tax return is rejected notifying the taxpayer a tax return was previously filed.

If you receive a letter from the IRS notifying you of potential identity theft you should:

- Follow the instructions in the letter and make contact using the information provided.

- Contact one of the credit reporting agencies (Equifax, Experian, or TransUnion) to put a fraud alert on your account.

- Obtain a credit monitoring service. These are usually provided free of charge by the source company where the breach of the stolen information was made. This is often true when a large retailer is breached but not the case with the IRS.

- Fill out Form 8821-A IRS Disclosure Authorization.

- For subsequent years, request a special PIN number from the IRS used to verify your identity when filing returns.

If your return has been rejected due to a return already being filed under your name you should complete the above and:

- Call the IRS Identity Theft Hotline: 1-800-908-4490.

- Ask your tax preparer to file IRS Form 14039 Identity Theft Affidavit notifying the IRS of potential identity theft, with attached proof of identity. The IRS will provide the special PIN to file your return. Do not lose this PIN as it is not visible to IRS agents answering call center phones.

You can lessen your risk of identity theft by keeping all personal and financial records in a secure place, not carrying your Social Security card, not responding or clicking on links from suspicious e-mails and monitoring bank accounts / credit cards for unusual charges.

The IRS takes this seriously and is actively working on return fraud. Applying for your individual PIN is probably the most effective action.

Finally, the IRS never e-mails you nor generally calls you directly. If you get an e-mail appearing to be from the IRS immediately delete it. Don’t return voice mails left by individuals identifying themselves as IRS agents unless you were expecting a return call from a specific agent. If you find yourself a victim of IRS identity theft, your tax preparer can assist you in navigating the steps required to resolve the matter.

Kristine Loomis is a Certified Public Accountant with Cordell, Neher & Company, PLLC, a Wenatchee public accounting firm.

Events & Deadlines

Latest Past Events

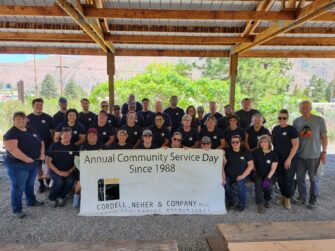

Community Service Day

Cordell Neher & Company, PLLC 175 E Penny Rd #1, Wenatchee2024 Shred Event

Cordell Neher & Company, PLLC 175 E Penny Rd #1, WenatcheeCNC Newsletter

Subscribe and stay informed on policy changes that could have an impact on you.

Footer Contact

Check the background of your financial professional on FINRA's BrokerCheck®

Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor. Cordell, Neher & Company, PLLC makes every attempt to ensure that the information contained on their websites are obtained from reliable sources, but is not responsible for any errors and/or omissions or from the results obtained from the use of any information. This site contains links to servers maintained by other organizations. Cordell, Neher & Company, PLLC cannot provide any warranty regarding the accuracy or source of information found on any of these servers, the content of any file the user might use to download from a third-party site, and is not responsibility for the content found on any of these servers or for any links these servers maintain with other servers.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM,Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100 Dallas, TX 75019 972-870-6000.

Avantax financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services.SM, Member FINRA, SIPC. Investment Advisory Services offered through Avantax Advisory Services SM. Insurance services offered through an Avantax affiliated insurance agency. Method 10® is property of Avantax Wealth Management.SM All rights reserved 2020. The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth ManagementSM does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth ManagementSM or its subsidiaries. Avantax Wealth ManagementSM is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products: Are not insured by the FDIC or any federal government agency- Are not deposits of or guaranteed by the bank or any bank affiliate- May lose Value

Avantax Investment ServicesSM and Avantax Advisory ServicesSM are not affiliated with CNC Financial Group, LLC.

© 2024 Cordell, Neher & Company PLLC • Designed by Pixel to Press